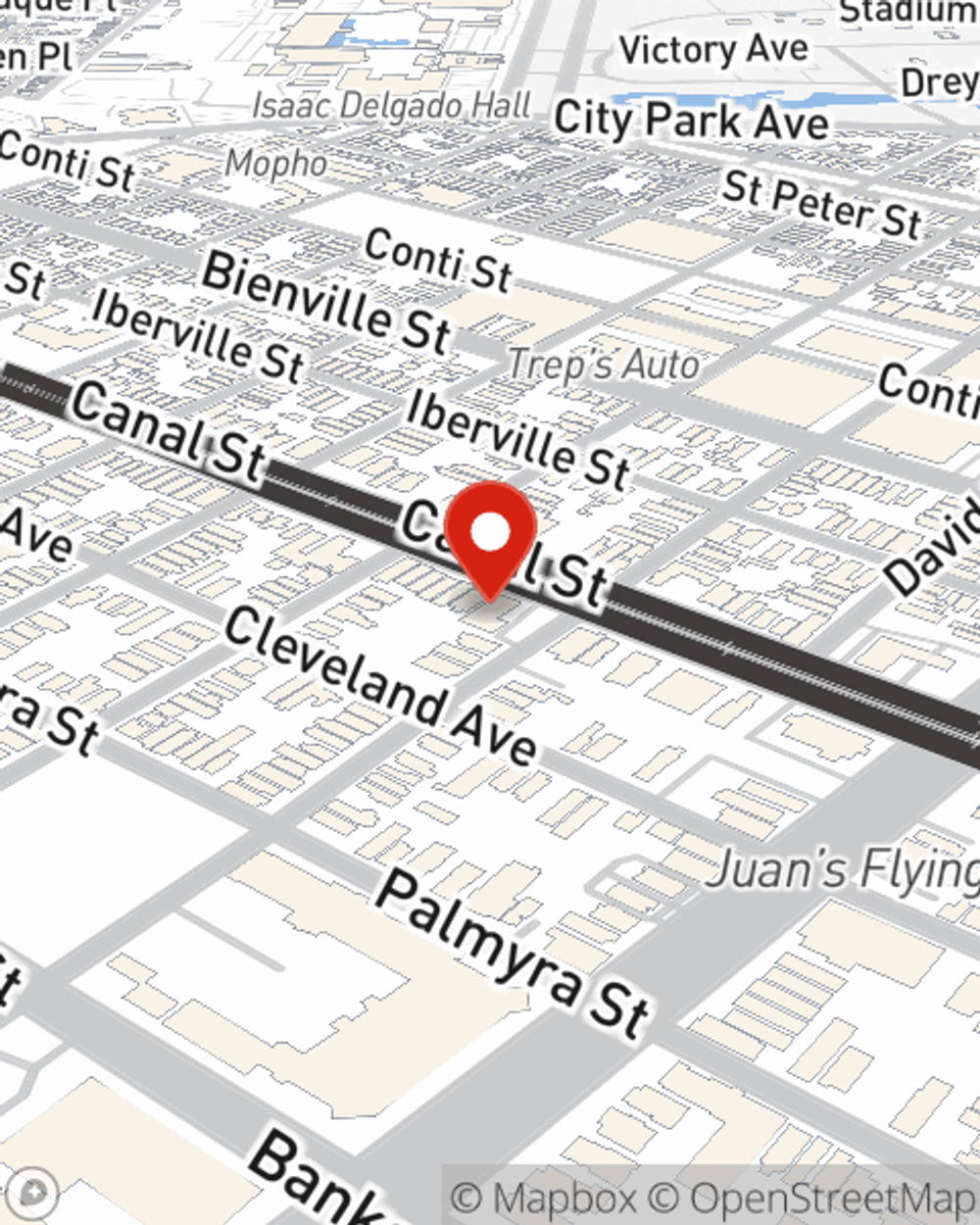

Business Insurance in and around New Orleans

New Orleans! Look no further for small business insurance.

Insure your business, intentionally

This Coverage Is Worth It.

Do you feel like there's so many moving pieces and it's hard to keep it all straight when it comes to owning your small business? It can be a lot to manage! Let State Farm agent Josh Lorando help you learn about your business insurance.

New Orleans! Look no further for small business insurance.

Insure your business, intentionally

Small Business Insurance You Can Count On

Did you know that State Farm has been helping small businesses grow since 1935? Business owners like you have relied upon State Farm for coverage from countless industries. It doesn't matter if you are an HVAC contractor or a photographer or you own a music school or a pet store. Whatever your business, State Farm might help cover it with customizable policies that meet each owner's specific needs. It all starts with State Farm agent Josh Lorando. Josh Lorando is the person who relates to where you are firsthand because all State Farm agents are business owners themselves. Contact a State Farm agent to understand your small business insurance options

Visit the terrific team at agent Josh Lorando's office to explore the options that may be right for you and your small business.

Simple Insights®

Before you rent, ask your landlord about move-costs and monthly bills due

Before you rent, ask your landlord about move-costs and monthly bills due

Rent, deposits and fees can sometimes get tricky if they haven't been discussed thoroughly with your landlord before signing a rental agreement.

Consider a Simplified Employee Pension plan for your small business

Consider a Simplified Employee Pension plan for your small business

Simplified Employee Pension IRA (SEP IRA) plans are employee IRAs funded by tax-deductible contributions from small business employers.

Josh Lorando

State Farm® Insurance AgentSimple Insights®

Before you rent, ask your landlord about move-costs and monthly bills due

Before you rent, ask your landlord about move-costs and monthly bills due

Rent, deposits and fees can sometimes get tricky if they haven't been discussed thoroughly with your landlord before signing a rental agreement.

Consider a Simplified Employee Pension plan for your small business

Consider a Simplified Employee Pension plan for your small business

Simplified Employee Pension IRA (SEP IRA) plans are employee IRAs funded by tax-deductible contributions from small business employers.